Overview

Your needs are unique. Our benefits program includes four medical plan options with a range of coverage levels and costs, so you can choose the one that’s best for you and your family. These plans are all administered by Aetna. You can enroll as a new hire, during Open Enrollment, or if you have a qualifying life event. To see your contributions and enroll, log in to Workday.

2025 medical plans

High Deductible Health Plan with HSA (HDHP)

Take control of your spending by keeping more of your paycheck through lower contributions, in exchange for higher deductibles.

Open Access Network Only 80/0 Plan

Receive coverage for in-network care only (except for emergencies), while saving money with relatively low contributions and the lowest deductibles of all four plans.

Choice POS II 80/60 Plan

Balance the cost of your coverage and your care with relatively low deductibles and moderate contributions.

Choice POS II 90/80 Plan

Keep your out-of-pocket costs as low as possible by paying a low coinsurance percentage and smaller copays, in exchange for higher contributions from your paycheck.

Key Features at a Glance

All our medical plans provide

Comprehensive, affordable coverage

for a wide range of health care services. Tip: If you need extra protection from large or unexpected medical expenses, you may also choose to enroll in supplemental medical coverage.

In-network preventive care covered at 100%,

including annual physicals, recommended immunizations, and routine cancer screenings, so you can protect your health. See more covered preventive services.

Prescription drug coverage

included with each medical plan. Prescription benefits are provided by Aetna.

Access to a broad network of providers

who have agreed to discounted fees for covered services. All plans (except the Open Access Network Only 80/0 Plan, which does not provide out of-network coverage for non-emergency care) offer the flexibility to see any provider you choose, but you’ll receive a higher level of coverage when you stay in-network.

Financial protection

through annual out-of-pocket maximums that limit the amount you’ll pay each year.

Plan Comparison

| Plan Features | High Deductible Health Plan with HSA (HDHP) | Open Access Network Only 80/0 Plan | Choice POS II 80/60 Plan | Choice POS II 90/80 Plan |

|---|---|---|---|---|

| Annual Deductible (single/family) | ||||

| In-network | $2,000/$4,000 | $250/$625 | $500/$1,500 | $1,000/$2,000 |

| Out-of-network | $4,000/$8,000 | N/A | $1,000/$3,000 | $1,500/$3,000 |

| Coinsurance | ||||

| In-network | You pay 20%, plan plays 80% | You pay 20%, plan plays 80% | You pay 20%, plan plays 80% | You pay 10%, plan plays 90% |

| Out-of-network | You pay 40%, plan pays 60% | N/A | You pay 40%, plan pays 60% | You pay 20%, plan pays 80% |

| Annual Out-of-Pocket Maximum (single/family) | ||||

| In-network | $5,000/$10,000 | $4,000/$7,000 | $4,000/$7,000 | $3,000/$6,000 |

| Out-of-network | $10,000/$20,000 | N/A | $6,500/$12,000 | $4,000/$8,000 |

| Office Visit (Primary Care Physician) | ||||

| In-network | You pay 20% after deductible | $25 copay | $25 copay | $25 copay |

| Out-of-network | You pay 40% after deductible | N/A | You pay 40% after deductible | You pay 20% after deductible |

| Pharmacy (30-day supply; retail pharmacy; in-network only) | ||||

| Generic | $20 copay after deductible | $20 copay | $20 copay | $20 copay |

| Preferred brand | $30 copay after deductible | $30 copay | $30 copay | $30 copay |

| Non-preferred brand | $40 copay after deductible | $40 copay | $40 copay | $40 copay |

| Maximum Contribution to Savings or Spending Account (single/family) | ||||

| Flexible Spending Account | Limited Purpose FSA - $3,300 | Health Care FSA - $3,300 | Health Care FSA - $3,300 | Health Care FSA - $3,300 |

| Health Savings Account | HSA - $4,300/$8,550 (Company contribution: $500/$1,000) | Not eligible | Not eligible | Not eligible |

| Office Visit (Primary Care) | ||||

| Preventive care | Covered at 100% in-network | Covered at 100% in-network | Covered at 100% in-network | Covered at 100% in-network |

| Office Visit (Specialist) | ||||

| In-network | You pay 20% after deductible | $50 copay | $50 copay | $40 copay |

| Out-of-network | You pay 40% after deductible | N/A | You pay 40% after deductible | You pay 20% after deductible |

| Telehealth Visit (General Medicine) | ||||

| In-network only | You pay 20% after deductible | $25 copay | $25 copay | $25 copay |

| Telehealth (Specialist) | ||||

| In-network only | You pay 20% after deductible | $50 copay | $50 copay | $40 copay |

| Urgent Care Visit | ||||

| In-network | You pay 20% after deductible | $25 copay | $25 copay | $25 copay |

| Out-of-network | You pay 40% after deductible | N/A | $25 copay | $25 copay |

| Physical Therapy | ||||

| Visit limits | 90 visits | 90 visits | Unlimited | Unlimited |

| In-network | You pay 20% after deductible | $50 copay | $50 copay | $40 copay |

| Out-of-network | You pay 40% after deductible | N/A | You pay 40% after deductible | You pay 20% after deductible |

| Speech and Occupational Therapy | ||||

| Visit limits | 90 visits | 90 visits | Unlimited | Unlimited |

| In-network | You pay 20% after deductible | $50 copay | $50 copay | You pay 10% after deductible |

| Out-of-network | You pay 40% after deductible | N/A | You pay 40% after deductible | You pay 20% after deductible |

| Outpatient Mental Health (unlimited) | ||||

| In-network | You pay 20% after deductible | $50 copay | $50 copay | $40 copay |

| Out-of-network | You pay 40% after deductible | N/A | You pay 40% after deductible | You pay 20% after deductible |

| Chiropractic Care | ||||

| Visit limits | Unlimited | Unlimited | Unlimited | Unlimited |

| In-network | You pay 20% after deductible | $50 copay | $50 copay | $40 copay |

| Out-of-network | You pay 40% after deductible | N/A | You pay 40% after deductible | You pay 20% after deductible |

| X-Ray & Lab | ||||

| In-network | You pay 20% after deductible | You pay $0, covered 100% | You pay 20%, no deductible | You pay 10% after deductible |

| Out-of-network | You pay 40% after deductible | N/A | You pay 20%, no deductible | You pay 20% after deductible |

| Hospital Emergency Room Visit | ||||

| In- and out-of-network | You pay 20% after deductible | $200 copay | $200 copay | $200 copay |

| Ambulance | ||||

| In- and out-of-network | You pay 20% after deductible | You pay 20% after deductible | You pay 20% after deductible | You pay 10% after deductible |

| Inpatient Hospitalization | ||||

| In-network | You pay 20% after deductible | You pay 20% after deductible | You pay 20% after deductible | You pay 10% after deductible |

| Out-of-network | You pay 40% after deductible | N/A | You pay 40% after deductible + $500 per admission | You pay 20% after deductible |

| Outpatient Surgery | ||||

| In-network | You pay 20% after deductible | You pay 20% after deductible | You pay 20% after deductible | You pay 10% after deductible |

| Out-of-network | You pay 40% after deductible | N/A | You pay 40% after deductible + $500 per admission | You pay 20% after deductible |

| Enhanced Infertility (Includes Cryopreservation) | ||||

| In- and out-of-network | $50,000 lifetime maximum | $50,000 lifetime maximum | $50,000 lifetime maximum | $50,000 lifetime maximum |

High Deductible Health Plan with HSA (HDHP)

The High Deductible Health Plan with HSA (HDHP) offers low-contribution, high-deductible coverage to give you more control over your money and reward you for making healthy, cost-conscious choices. You can also save on healthcare expenses through tax-free contributions to a Health Savings Account (HSA). With this plan, you can see any provider you wish, but you will pay less when you stay in-network.

How the High Deductible Health Plan with HSA (HDHP) works

You pay the plan’s contributions from your paycheck to have coverage.

Keep in mind: You pay nothing for in-network preventive care — it’s covered in full.

*When you go out of network, the deductible applies to all non-emergency care, then you pay 40% coinsurance.

Save money with an HSA*

A Health Savings Account (HSA) lets you take advantage of tax-free savings when paying for health care costs such as doctor’s visits, prescriptions, deductibles and other medical expenses. You can set aside money before taxes are taken out of your paycheck. The Company will contribute to your HSA too.

*You are only eligible for an HSA if you enroll in the High Deductible Health Plan with HSA (HDHP).

Open Access Network Only 80/0 Plan

The Open Access Network Only 80/0 Plan provides coverage only when you receive care from in-network providers, unless you need immediate care in a medical emergency. This plan has the lowest deductible and is the second least expensive plan in terms of paycheck contributions.

How the Open Access Network Only 80/0 Plan works

You pay the plan’s contribution from your paycheck to have coverage.

Keep in mind: You pay nothing for in-network preventive care — it’s covered in full.

Save money with an FSA!

A Healthcare Flexible Spending Account (FSA) lets you take advantage of tax-free savings when paying for health care. But, be sure to plan your FSA contributions carefully for 2025: you can only carry over up to $660 of unused money in your FSA to the next year; you will forfeit any remaining amount above $660.

Choice POS II 80/60 Plan

The Choice POS II 80/60 Plan has a higher deductible and higher contributions than the Open Access Network Only 80/0 Plan, but offers the flexibility to see out-of-network providers with a lower level of benefits. Even though you can see any provider you wish, you’ll pay less when you stay in-network.

How the Choice POS II 80/60 Plan works

You pay the plan’s contribution from your paycheck to have coverage.

Keep in mind: You pay nothing for in-network preventive care — it’s covered in full.

*When you go out of network, the deductible applies to all non-emergency care except X-rays and lab work, then you pay 40% coinsurance. Out-of-network inpatient hospitalizations and outpatient surgery also charge a $500 copay per admission.

**Out-of-network coinsurance after deductible for ambulance service is 20%. Out-of-network coinsurance for X-rays and lab work is 20% with no deductible.

Save money with an FSA!

A Healthcare Flexible Spending Account (FSA) lets you take advantage of tax-free savings when paying for health care. But, be sure to plan your FSA contributions carefully for 2025: you can only carry over up to $660 of unused money in your FSA to the next year; you will forfeit any remaining amount above $660.

Choice POS II 90/80 Plan

The Choice POS II 90/80 Plan offers the lowest in-network copays and coinsurance, but you’ll pay the most out of your paycheck for coverage. The annual deductible is higher than the Open Access Network Only 80/0 Plan and Choice POS II 80/60 Plan but much lower than the High Deductible Health Plan with HSA (HDHP). With this plan, you can see any provider you wish, but you will pay less when you stay in-network.

How the Choice POS II 90/80 Plan works

You pay the plan’s contribution from your paycheck to have coverage.

Keep in mind: You pay nothing for in-network preventive care — it’s covered in full.

*When you go out of network, the deductible applies to all non-emergency care, then you pay 20% coinsurance (10% coinsurance for ambulance service).

Save money with an FSA!

A Healthcare Flexible Spending Account (FSA) lets you take advantage of tax-free savings when paying for health care. But, be sure to plan your FSA contributions carefully for 2025: you can only carry over up to $660 of unused money in your FSA to the next year; you will forfeit any remaining amount above $660.

Prescription Drugs

When you enroll in a Company medical plan, you automatically receive prescription benefits provided by Aetna in partnership with CVS.

Drug tiers

The cost of your prescription drugs under each medical plan depends on the tier of the medication — generic, preferred brand, or non-preferred brand. All prescription carriers have a formulary, or list of preferred drugs based on effectiveness and cost.

Check the formulary

See how medications are covered by logging in to your prescription account on the Aetna website.

Save money on your prescriptions!

The cost of prescription drugs is rising faster than many other health care services and supplies. But, there are ways for you to save.

Ask your doctor about generic medications.

Generic medications are generally just as effective as brand-name medications, but they typically cost between 80% and 85% less.

If a generic equivalent is not available, check for a preferred brand-name option.

Medications identified as preferred on Aetna’s prescription drug formulary have been selected for their effectiveness and lower cost compared to other brand-name drugs.

Use the home delivery feature.

If you take maintenance medication to treat a chronic condition — such as an allergy, heart disease, high blood pressure, or diabetes — the convenience and cost savings of the home delivery prescription program through Aetna will save you time and money.

Save with PrudentRx.

PrudentRx helps you reduce how much money you spend on certain specialty medications. If you take an eligible medication, you will be automatically enrolled in PrudentRx and receive a $0 copay – no action is needed. Review the PrudentRx FAQs to learn more.

Why use home delivery?

- Prescriptions are shipped to you for free — no waiting in line at the pharmacy.

- You save money with a reduced cost for a three-month supply.

- You can set up automatic refills.

Telehealth

When you enroll in an Company medical plan, you have anytime, anywhere access to medical advice from board-certified physicians for fast, convenient diagnosis and treatment of many common conditions through CVS Virtual Care. Connect to a doctor for general medicine visits 24/7 over the phone or through video chat using the CVS Virtual Care mobile app or website, or use CVS Virtual Care to schedule an appointment with a licensed behavioral health provider or dermatologist from the comfort of your home.

- Choose when: day or night, weekdays, weekends, and holidays

- Choose where: home, work, or on the go

- Choose how: phone or video chat

General Medicine Visits

Connect with a doctor — whenever and wherever you need one — for minor illnesses and injuries like cold, flu, sore throat, strains and sprains, dermatology concerns, and more. General medicine visit costs are based on your medical plan design, and can be safer and more convenient than a doctor's office visit.

Mental Health Services

Establish an ongoing relationship with a behavioral health provider by phone or video for issues like stress, anxiety, depression, grief, family issues, substance use, and more. You and your covered dependents can access CVS Virtual Care behavioral health services for the same price as an in-network specialist visit under your Company medical plan.

Register on the CVS Virtual Care website and set up your profile to begin using these services today!

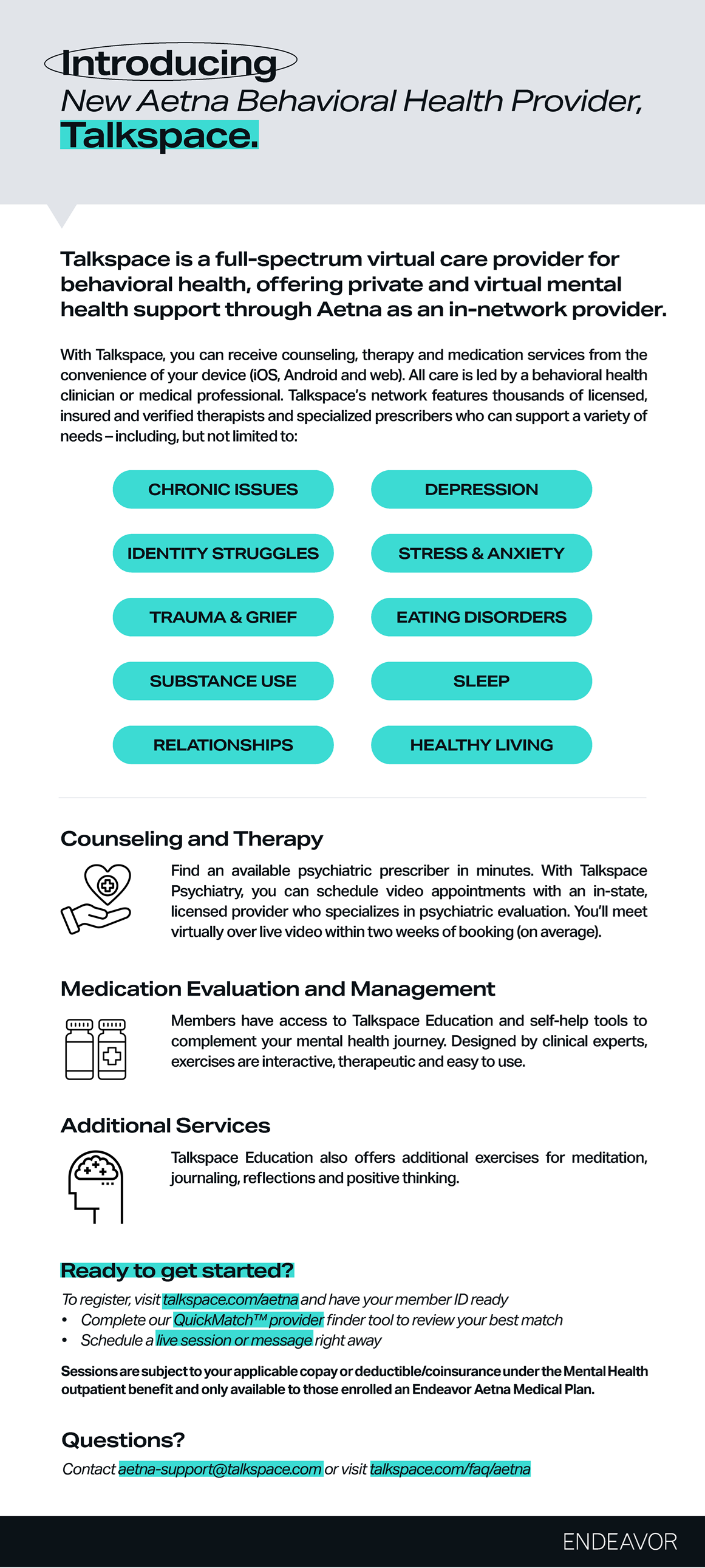

Talkspace

AbleTo

AbleTo, offered through your Aetna medical insurance,* offers comprehensive mental health support to individuals seeking personalized care. Through telehealth services, AbleTo connects users with licensed therapists and behavioral health coaches, fostering a tailored approach to address various mental health challenges and enhance overall well-being.

What makes this program different from other telemedicine services? AbleTo, offers the following:

- A short-term, eight-week model

- Includes therapy plus coaching

- Allows for flexible scheduling

- Helps you take control of your health and life

Get started today.

- To make it easy, Aetna will call you if your claims data shows you may benefit from this program

- If you have not been contacted but believe this program is right for you, reach out!

- AbleTo.com/Aetna

- 1-844-330-3648

- Tell your Aetna case manager you'd like to participate

*In many cases, AbleTo, services are available with no out-of-pocket cost to you, but in some instances, deductibles will apply before your out-of-pocket expenses are covered. Just call the number on your member ID card to learn more about your options.

Find a Doctor

Using in-network providers saves you money — and if you enroll in the Open Access Network Only 80/0 Plan, you must stay in-network to receive coverage. Here’s how to find doctors in your medical plan network:

- Visit the Aetna website.

- Select "Open Access Aetna Select" for the 80% In-network only plan; Select “Aetna Choice POS II (Open Access)" for all other plan options.

- Enter your home ZIP code and select the distance you'd be willing to travel.

- Enter the type of provider you would like to search for.

Why use a network provider?

- When you stay in-network, you pay less money out-of-pocket without compromising the quality of care.

- When you see in-network providers, you receive a higher level of coverage and you benefit from discounted fees for covered in-network services.

- Many physicians, hospitals, and other health care providers participate in the Aetna nationwide network.

If you go to an out-of-network provider:

- You pay more out-of-pocket.

- You must meet a higher annual deductible.

- Eligible expenses are typically reimbursed at lower rates than in-network expenses (or not at all under the Open Access Network Only 80/0 Plan.

Women’s Health

The health and wellbeing of all employees is a very significant focus that the Company takes seriously. This toolkit has been created to address the specific health issues which impact many women during their working lives. It aims to bring light to invisible challenges, educate employees, and provide support to women in need.

The toolkit has resources that can help you or your covered dependents with:

- Preventive Care

- Fertility Challenges

- Miscarriages

- Pregnancy & Pre-Natal Care

- New Mothers / New Baby Care

- Nursing / Traveling Mothers (Milk Stork)

- Premenstrual Syndrome (PMS)

- Menopause

And that’s just the beginning! For more programs and resources to support women, visit the Women's Health section of the Resources page. You’ll find LGBTQ+ FAQs, Breast Cancer and Cervical Cancer resources, the Company’s Pregnancy Loss Leave Policy, information about Milk Stork, and much more.

Money-Saving Tips

When you carefully consider the financial impact of your health care choices, you can help lower costs for yourself and the entire company. Get the most from your medical benefits by following these tips to be well and buy smart:

- Use in-network providers. They’ve agreed to charge only up to negotiated rates and bill your insurance company directly, which saves you money and time. Also, check with your insurance company to ensure that a service is covered before you receive care. Note: If you’re enrolling in the Open Access Network Only 80/0 Plan, the plan only pays benefits for care received in network.

- Keep up with preventive care. It’s covered in full by all of our medical plans and can help detect and prevent potentially costly health issues early. You pay nothing for annual physicals, recommended immunizations, routine cancer screenings, and more when you see in-network providers.

- Use tax-free money to pay for eligible health expenses. Contributing to a Healthcare Flexible Spending Account (FSA) or Health Savings Account (HSA) is easy and saves you money. You can set aside pre-tax dollars from your paycheck to use for your out-of-pocket costs. Keep in mind with an FSA, you can only carry over up to $660 of unused money in your FSA to the next year; you will forfeit amounts above $660. For the HSA, you can contribute up to $4,300 for single coverage and up to $8,550 for all other coverage. Don’t forget that the Company will contribute to your HSA too. Remember, you must be enrolled in the High Deductible Health Plan with HSA (HDHP) to contribute to an HSA.

- Shop smart for prescriptions. Using generic alternatives will almost always save you money — and they’re just as safe and effective as brand-name prescriptions. Also, try calling a few local pharmacies to compare prices before deciding where to fill a prescription. For your ongoing prescriptions, use the home-delivery service to save money and time.

- Use your medical plan’s website. Log in to the Aetna website to review claims, find in-network providers, use helpful cost-estimating tools, and more.